In a world where financial stability and smart money management are more crucial than ever, it’s essential to equip ourselves with the knowledge and strategies to make the most of every dollar. Welcome to our money-saving blog series, where we delve into practical tips, insightful advice, and creative approaches to help you stretch your hard-earned money further.

As you embark on this journey towards financial empowerment, it’s important to note that while we aim to provide valuable information, we are not financial advisors, and our advice is not legally binding. Additionally, in our commitment to transparency, we want to inform you that we may occasionally use affiliate links, which help support the maintenance of this platform. So, let’s navigate the realm of money-saving together, bearing in mind the importance of making well-informed decisions tailored to your unique financial situation.

Let’s dig into little known tips, secrets and hacks that will put more money in your pocket!

Save Money on Amazon

Getting the best price

Saving money on Amazon can be quite a strategic endeavor, as the platform offers a vast range of products and deals. Whether you’re an occasional shopper or a frequent Amazon user, here are 5 little-known tips to help you save money while shopping on the platform!

- Amazon Coupons and Deals: Amazon often offers digital coupons and deals that you can apply to your purchases. These can be found on the product pages or in the “Today’s Deals” section. Make sure to clip the coupons before adding items to your cart to take advantage of the discounts.

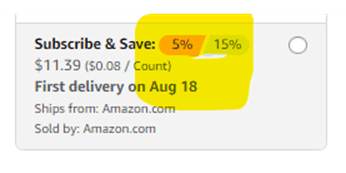

2. Subscribe and Save: If you frequently purchase certain items, consider using the “Subscribe and Save” feature. This allows you to set up regular deliveries of items you use regularly, and you’ll typically receive a discount for subscribing. Plus, you can always adjust your subscription frequency or cancel at any time.

3. Amazon Warehouse: Want to save up to 50% from Amazon? Never buy anything without checking the Amazon special discount store- the Amazon Warehouse that most people don’t know about! The Amazon Warehouse section offers discounts on open-box and pre-owned products across various categories. These items are usually tested and certified by Amazon, so you can still get quality products at a reduced price!

Follow these steps and save:

- Go to Google and type “Amazon warehouse USA”

- Click first link

- Now search just like you’re using Amazon normally and save up to 50%!

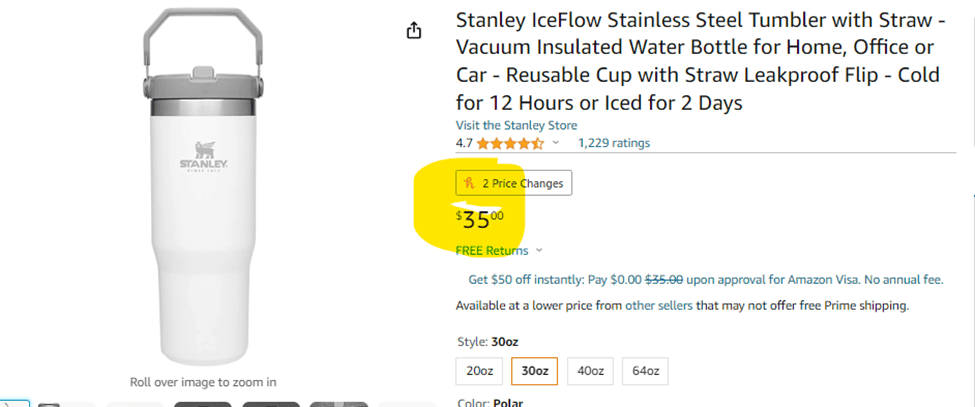

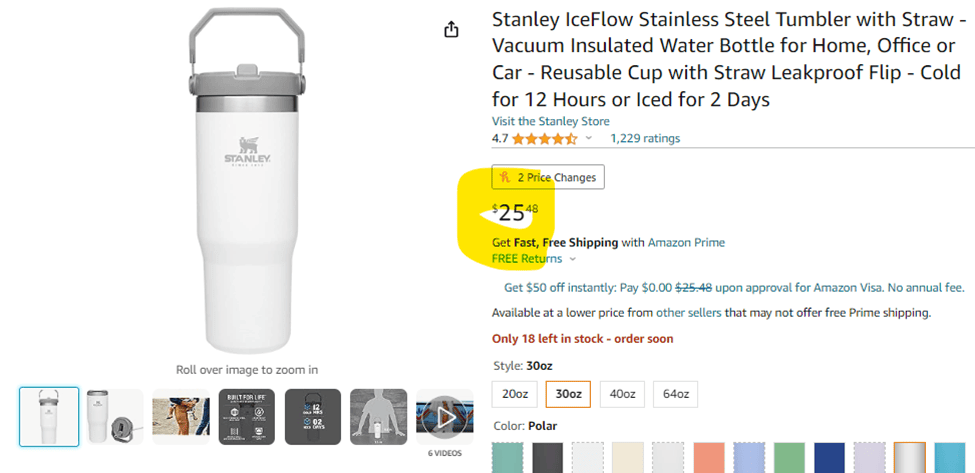

“Normal” Amazon

Amazon Warehouse

4. Amazon Outlet: Did you know that you can save up to 50% off overstocked items from Amazon? This is another special discount store that most people don’t know about from Amazon!

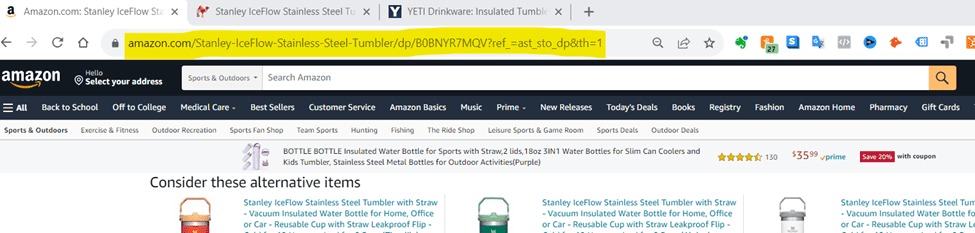

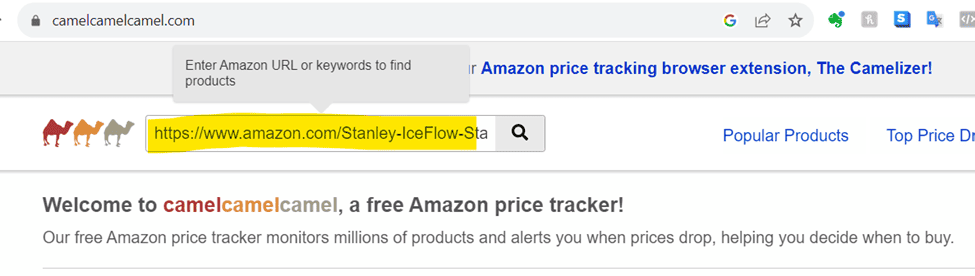

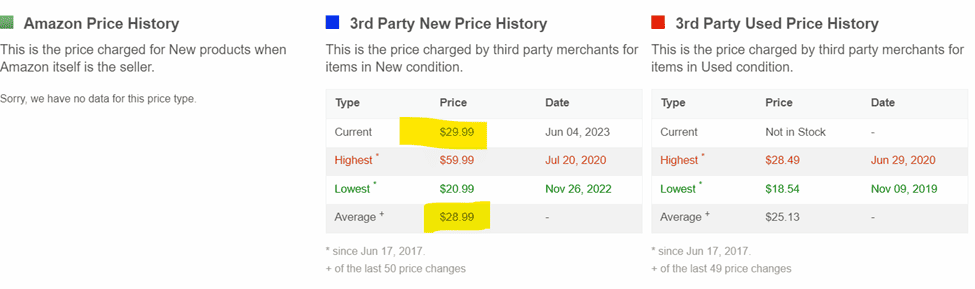

5. Compare Prices: Do you wonder if you’re getting the best price on Amazon? You should- because prices are always changing! Make sure you’re getting the best price on Amazon by using camelcamelcamel!

Camelcamelcamel allows you to monitor pricing of Amazon items so you can see the best time to buy!

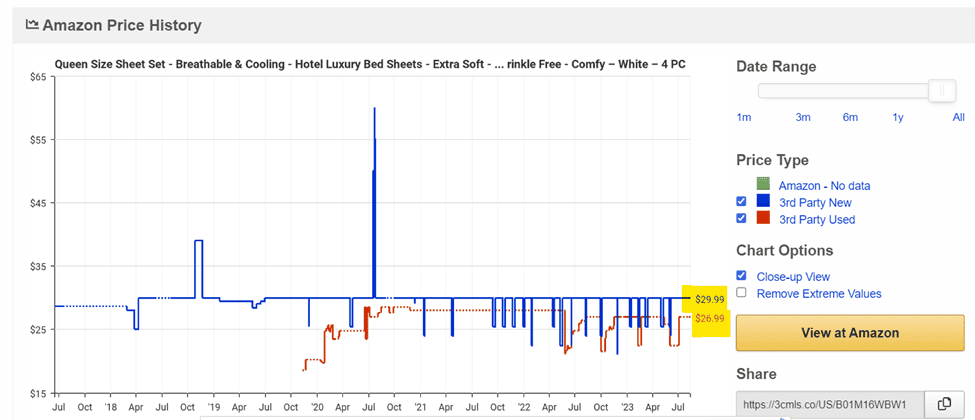

- Find the product you’re looking for on Amazon, and copy the URL link:

- Go to Camel camel camel and paste the URL link from Amazon at the top

- Look for pricing changes (for example, Black Friday)

- Determine the best time to make your purchase!

Shop Smarter at Costco

Did you know that there are secret codes that you can look for at Costco??! That’s right, the price tags will tell you if the item is on clearance, manager markdown, or full price!

Here’s the cheat sheet:

Price tags ending in .99= regular price point

Price tags ending in .97= marked down and on sale

Price tags ending in .00= manager markdown and on sale

Asterisk* at the top right corner? That means the item will no longer be restocked…so stack up if it’s something you need!

Get free money from Facebook

(this is real…and the Deadline is August 25, 2023)

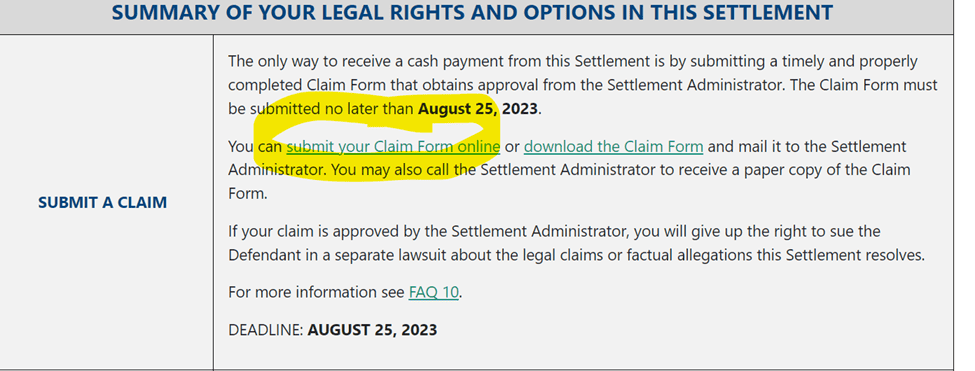

Facebook lost a court case and was ordered to pay $725,000,000!

Who qualifies? If you had a Facebook account between May 2007- December 2022, you qualify! Here’s how to get your share of the payout:

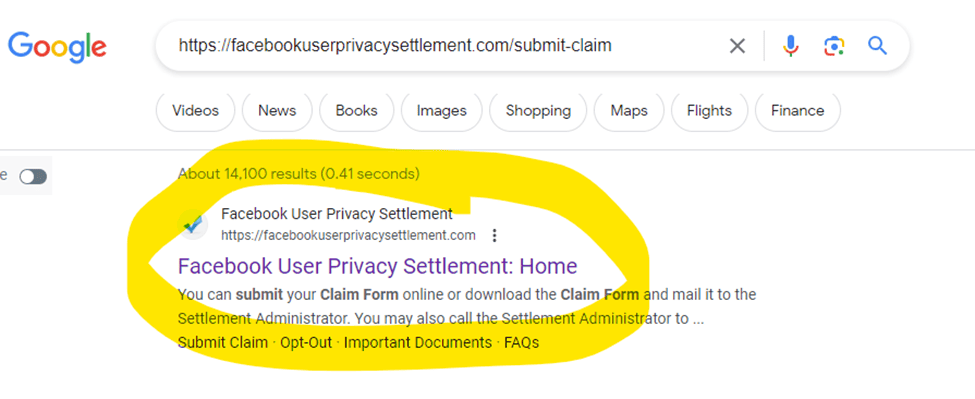

- Go to Google and type “facebookuserprivacysettlement.com/submit-claim”

- Click the first link

3. Scroll down and look for “submit your Claim Form online”

4. Click the link and complete the form

5. Choose how you’d like to receive your payment

6. Once completed, hit Submit

You should see a payment within 2-3 business days!

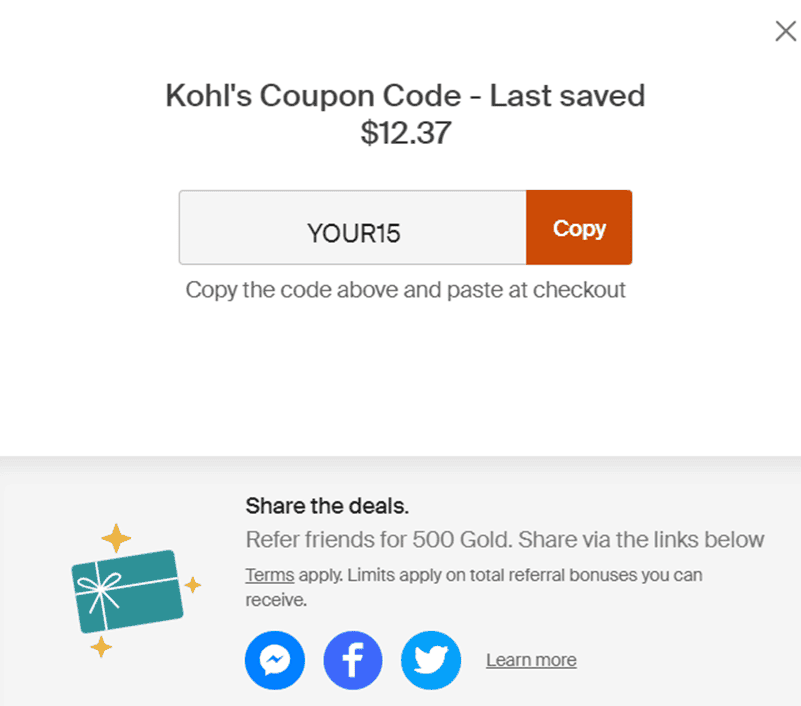

Online Shopping Discount Codes

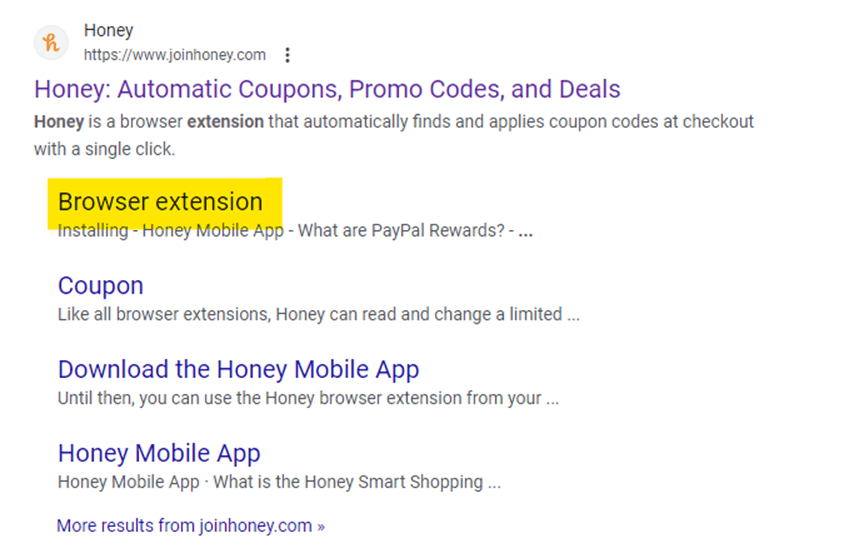

Do you ever see “Coupon Code” when buying something online? If you weren’t provided one, you may be tempted to search all over the internet for something that works…and most of the time they don’t work or require you to sign up for something you’re not sure about (and end up on a mailing list).

What if there was an easy way to find and use online coupons without wasting your time? Great news- there is a browser extension that you can use that will do all of the searching for you, and even apply the coupon codes when you’re ready to check out!

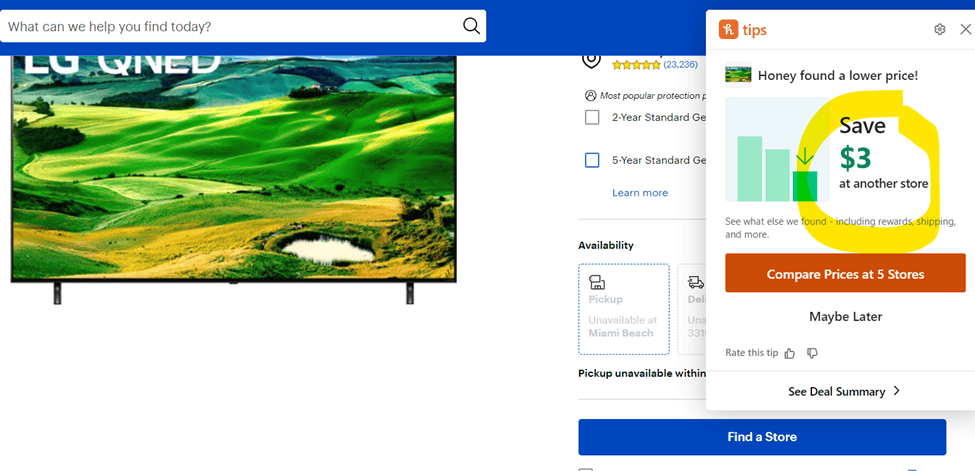

With Honey, you’ll be able to:

- Find the lowest price offers available online

- Know how much you can save by shopping elsewhere

- See when the best times to buy a particular item are

- Make sure that the discount you’re using is really the best price

- Access coupon codes that WORK without having to submit your information anywhere

Ready to start saving all over the internet? Follow these steps!

- Go to Google and search for “honey extension” then look for this link:

2. Click the link and add follow the instructions to add the extension to your browser

3. Follow these instructions and get ready to save- it will look like this when you’re all set up!

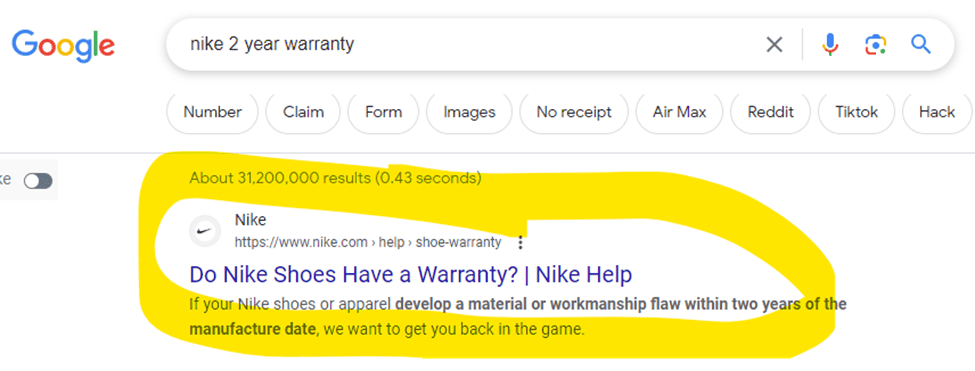

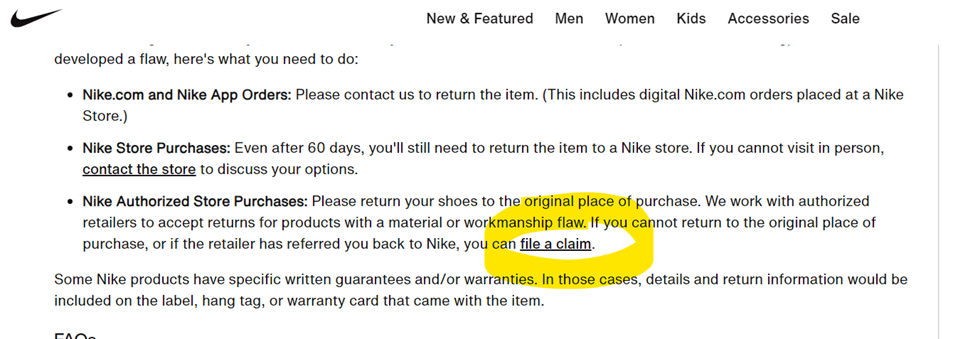

Return/Replace old Nike shoes for FREE

Do you have Nike shoes less than 2 years old that need to be repaired, replaced, or returned? Don’t go buy another pair– until you follow these instructions. Soon you’ll be able to get them returned or replaced for FREE!

But wait, if you contact Nike they’ll like ask for a receipt and that they “have a 60-day return policy” …what if you don’t have a receipt??

Don’t worry! Just follow the instructions below:

1. Look at the tag on the inside of your shoes– you’ll find the manufactured date on the tag of your shoes. If they’re less than 2 years old- you’re in luck.

2. Google “Nike 2 year warranty”

3. Click the first link

4. Scroll down

5. Click on the link called “file a claim,” which looks like this:

6. Complete the form and voila- you’re all set!

Buying/Selling a Vehicle

Buying a car

Financing with a bad credit score?

- Go to Smart Credit by clicking this link to get your credit score higher (and even save money off of bills)- it only costs five dollars to sign up

- Once you’ve signed up, use the “Score Boost” feature

- You’ll be able to get help with collections, find the best times to make credit card payments and many other ways that will reduce your financial burden. It will even help you create and implement a plan on how to get to the credit score that will get your monthly car payment down!

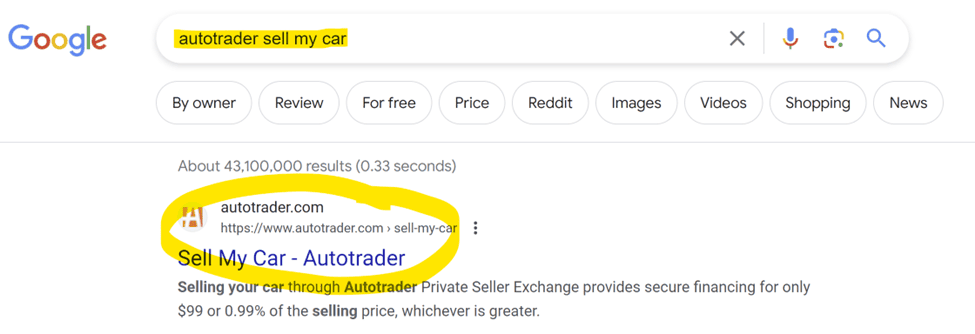

Selling a car

Is it time to sell a car? The easy option is to put a sign on your car and take the first offer you get when you want to sell it- at least it seems like the least frustrating route. Don’t do that!

Make that sign digital and show it to a much bigger audience than you’d get driving it around (or parking it somewhere) by selling it on Autotrader.com. By doing this, you’ll get the opportunity to get a much higher payment for your beloved vehicle!

Other benefits of doing this include:

- Wide Audience Reach: AutoTrader is a popular and well-established platform with a large user base. This means your listing can potentially reach a broad audience of potential buyers, increasing the chances of finding the right buyer for your car.

- Targeted Listings: AutoTrader allows you to provide detailed information about your car, including its make, model, year, condition, and features. This helps you create a targeted listing that attracts buyers specifically interested in your type of vehicle.

- Visibility: AutoTrader offers various listing packages that can boost the visibility of your ad. Featured listings or premium packages might place your ad at the top of search results, making it more likely for potential buyers to notice your listing.

- Professional Presentation: AutoTrader provides tools to help you create a professional-looking listing with high-quality photos, detailed descriptions, and even videos. A well-presented listing can attract more attention and help build trust with potential buyers.

- Credibility and Trust: AutoTrader’s reputation as a reputable and trusted platform can enhance your listing’s credibility. Buyers often feel more comfortable purchasing from a well-known platform with a track record of successful transactions.

- Market Insights: AutoTrader often provides information about market trends, such as average prices for similar vehicles, which can help you set a competitive and realistic asking price for your car.

- Negotiation Control: When you list your car on AutoTrader, you have control over the selling process, including negotiations with potential buyers. You can communicate directly with interested parties and negotiate terms that work for both parties.

- Convenience: Selling a car on AutoTrader can be more convenient than dealing with classified ads or private sales. You can manage inquiries, schedule test drives, and handle negotiations all within the platform.

- Additional Services: Depending on the package you choose, AutoTrader might offer additional services such as vehicle history reports, ad renewals, and enhanced customer support to help facilitate the selling process.

- Time and Effort Savings: Using a platform like AutoTrader can save you time and effort compared to traditional methods of selling, as you won’t need to field as many phone calls or respond to as many inquiries from potential buyers.

- Added safety: an ID verification system helps avoid being in an uncomfortable situation with a stranger

Remember that while AutoTrader offers numerous benefits, there might also be associated fees for listing your car on the platform. It’s a good idea to weigh these benefits against any costs to determine if selling your car on AutoTrader is the right choice for you.

Get the highest price for your car by simply following the directions below!

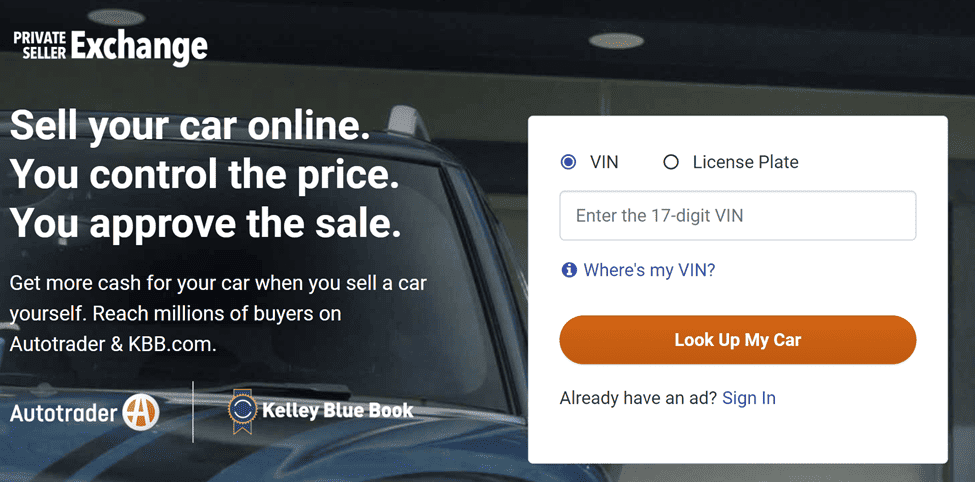

- Go online and search for “autotrader sell my car”

- Click on the link that says Sell My Care – Autotrader

3. Follow on screen instructions starting with your VIN or license plate number

4. Make sure to take great pictures after you’ve done a thorough job cleaning your vehicle– it makes a BIG difference to people searching for your vehicle

5. Enjoy that extra cash you made, and time saved!

Save money when buying a house

Did you know that you can not only save a lot of money on a downpayment for your house, but also get a loan that covers the cost of rehabbing the house?

Let’s say the house you’re looking to buy is $100,000, but it needs about $20,000 in repairs. Normally people tell you that you need to put down 20% of the total cost- in this case it would be $20,000. Plus, you’ll need an extra $20,000 for the repairs, bringing your out-of-pocket costs up to $40,00)!

These days, most people don’t have $40,000 laying around.

Great news- there’s a government program that allows you to put down as little as 3.5% ($4,200 in this case) and get a loan for the $100,000 house PLUS $20,000 to cover the cost of the repairs!

Make sure to take advantage of this program-you can read more about it here!

Improve your Credit Score

When your credit score is low, it can have various implications on your financial life. A credit score is a numerical representation of your creditworthiness, which is used by lenders and financial institutions to assess the risk of lending money to you. A low credit score indicates higher risk, and this can affect several aspects of your financial situation- keep reading to see how this impacts you and an easy way to avoid falling victim to this!

1. Difficulty in Obtaining Credit: Lenders might be hesitant to approve you for loans, credit cards, or other forms of credit if you have a low credit score. Even if you are approved, you might receive less favorable terms, higher interest rates, or lower credit limits.

2. Higher Interest Rates: If you do manage to secure credit with a low credit score, you’re likely to be offered higher interest rates. This means you’ll end up paying more in interest over the life of the loan, making borrowing more expensive.

3. Limited Access to Financial Products: Some financial products and services, such as premium credit cards or favorable mortgage rates, might be out of reach with a low credit score.

4. Difficulty Renting Housing: Landlords often check credit scores when considering potential tenants. A low credit score might make it harder to secure rental housing or require you to pay a higher security deposit.

5. Employment Considerations: In some cases, certain employers might check credit scores as part of the hiring process, especially for positions that involve financial responsibilities. While this is not common for all industries, it’s worth being aware of.

6. Insurance Premiums: Some insurance companies use credit scores to determine premiums for auto and homeowners’ insurance. A lower credit score could result in higher insurance costs.

7. Cell Phone Contracts and Utilities: When signing up for a cell phone plan or setting up utilities, providers might check your credit. A low score could result in the need for a security deposit or stricter terms.

8. Difficulty Starting a Business: If you’re looking to start a business and need financing, a low credit score might make it challenging to secure business loans or lines of credit.

9. Impact on Financial Goals: A low credit score can hinder your ability to achieve financial goals such as buying a home, getting a reliable car, or saving for retirement.

10. Emotional and Psychological Stress: Financial stress due to a low credit score can impact your mental and emotional well-being, affecting your overall quality of life.

It’s important to note that your credit score is NOT fixed and can improve over time with responsible financial habits. This includes making timely payments, reducing debt, and managing your credit responsibly. If you have a low credit score, consider seeking advice from a financial counselor or advisor to create a plan for improving your creditworthiness…you may even want to check out smartcredit.com. You’ll be able to get personalized suggestions to help you manage your finances and see the best and fastest ways to improve your credit score.

Keep reading for more tips!

Don’t cancel your unused credit cards!

Did you know that it’s better to keep unused credit cards open instead of closing them? By cancelling your card, you’ll hurt your credit score.

“What if my credit card has an annual fee that I don’t want to pay anymore?” This sounds tough, because you no longer want to pay the annual fee but also don’t want to hurt your credit score.

Good news- we have a solution that won’t hurt your credit score AND you can avoid paying the annual fee.

It’s a simple fix. Call your credit card company and ask them to downgrade to a free option.

We haven’t seen a card with an annual fee that doesn’t have a no-cost alternative option!

Do you have a bad credit score that’s impacting monthly payments?

Follow these tips to improve your score and lower your monthly payments:

- Go to Smart Credit by clicking this link to get your credit score higher (and even save money off of bills)- it only costs $5 to sign up

- Once you’ve signed up, use the “Score Boost” feature

- You’ll be able to get help with collections, find the best times to make credit card payments and many other ways that will reduce your financial burden. It will even help you create and implement a plan on how to get to the credit score that will get your monthly car payment down!

Free Refills at Starbucks

Don’t worry- we won’t tell you to find a less expensive alternative to Starbucks (like Dunkin” Donuts) if you’re hooked. We get it. Plus, how are you supposed to get into your routine without your caffeine and delicious snacks?

You may not be aware of this, but we have some good news that most people aren’t aware of…

Free refills! That’s right, if you’re in the Starbucks location, you can get unlimited free refills on hot coffee, hot tea, cold brew, iced coffee, and iced tea.

You’re welcome!

How to save BIG $$$ on 🏥 medical bills

Large medical bills can have significant and sometimes devastating impacts on individuals and families. Here are some of the ways in which these bills can affect low-income people:

1. Financial Strain: Low-income individuals often have limited financial resources to begin with. A large medical bill can quickly lead to financial strain, causing them to struggle to cover basic necessities such as rent, utilities, food, and transportation.

2. Debt Accumulation: Many low-income people may not have health insurance or may have insurance with high deductibles and copayments. When faced with a medical emergency or unexpected health issue, they might have to take on debt to pay the medical bills, which can accumulate over time.

3. Bankruptcy: In extreme cases, the burden of large medical bills can push low-income individuals and families into bankruptcy. Medical debt is a common cause of bankruptcy filings in the United States.

4. Delayed Care: Fear of incurring high medical costs can lead low-income individuals to delay seeking medical attention. This delay can worsen health conditions, leading to more serious and costly medical issues down the line.

5. Impact on Employment: Medical issues can lead to missed workdays, reduced productivity, or even job loss. For low-income individuals who rely on every paycheck, these disruptions can further strain their financial stability.

6. Limited Access to Care: Some low-income individuals might forego necessary medical care or treatments due to the inability to afford them. This can result in worsening health conditions and reduced quality of life.

7. Cyclical Poverty: Large medical bills can create a cycle of poverty. The financial impact of medical debt can make it difficult for individuals to save money, invest in education, or pursue opportunities for economic advancement.

8. Mental and Emotional Stress: Dealing with large medical bills and financial insecurity can lead to significant stress, anxiety, and depression. The emotional toll can affect overall well-being and ability to cope with daily challenges.

9. Interference with Long-Term Goals: Low-income individuals might aspire to improve their financial situation over time, such as buying a home or pursuing higher education. High medical bills can hinder these long-term goals.

10. **Disproportionate Impact on Marginalized Communities: Low-income individuals from marginalized communities, including racial and ethnic minorities, might face additional challenges due to systemic inequalities that intersect with their economic struggles.

To address the impacts of large medical bills on low-income people, there’s a need for comprehensive healthcare reform, expanded access to affordable healthcare, and social safety nets that provide financial assistance and support during times of medical crisis.

Community organizations, nonprofits, and advocacy groups also play a crucial role in providing assistance and resources to individuals facing medical debt and financial hardships. Don’t forget to check out our other blogs about disability healthcare here. We can also connect you with help when you apply here.

Do you have an existing medical bill that you’re having a difficult time paying?

Follow these easy steps to reduce your financial burden:

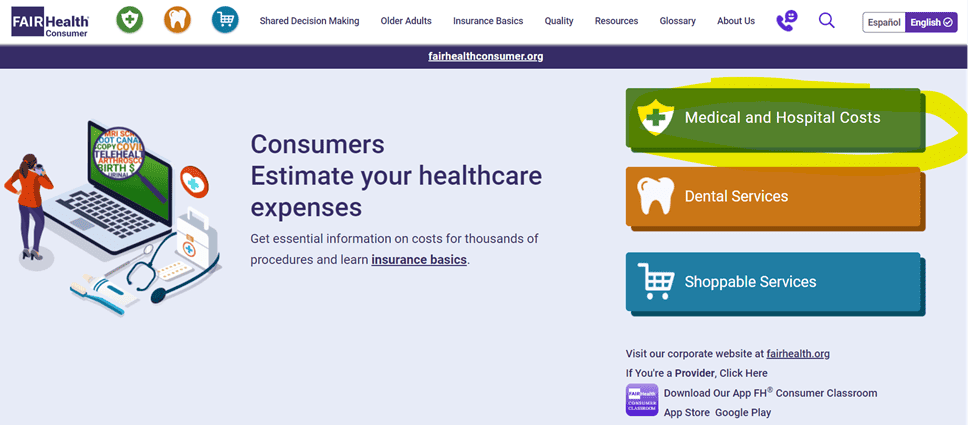

- Ask for an itemized bill of the medical services that you owe money for

- Go to Fairhealthconsumer.org

- You can search to find out if you paid a reasonable amount for your healthcare expense

4. If you are being asked to pay too much, show them your findings from your research

5. Finally, ask about pay in full discount or other options they have for people facing financial difficulties

This works- just remember to be polite!

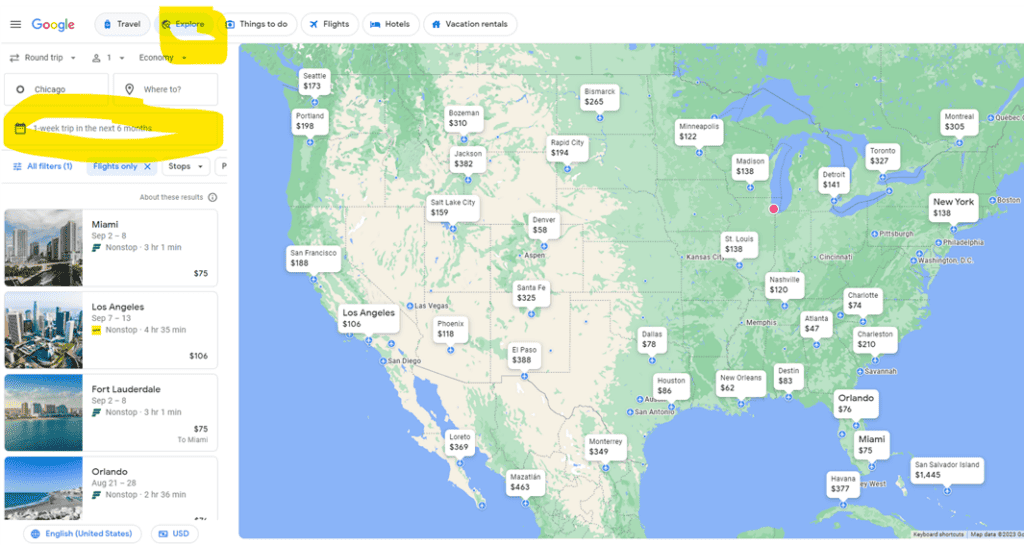

Save Money on Buying Flights

Have you noticed that flight prices have gone up substantially in the last 2 years? You’re not alone- but you may be the only one who knows this trick to save BIG on flights! Here’s how:

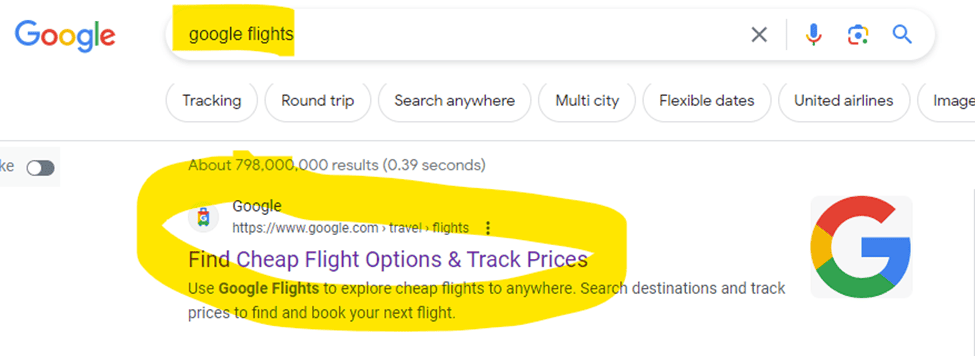

- Go to Browser: type in “Google Flights”

- Click first link:

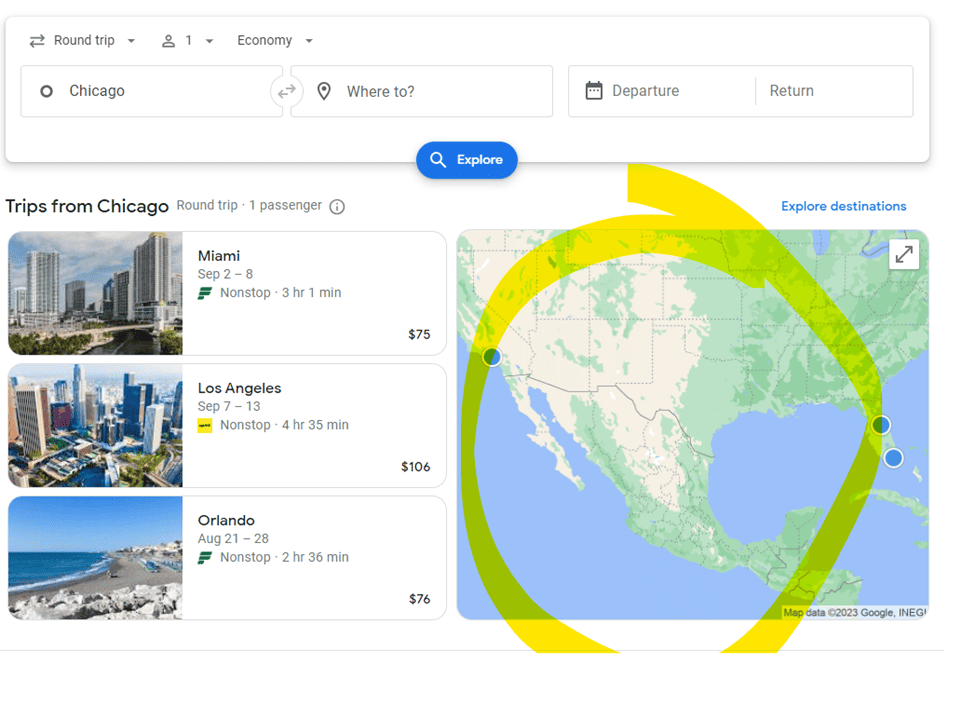

3. Put in round trip and where you’re leaving from NOT your destination

4. Remember- do NOT put your destination!

5. Click the map instead

6. Now you should see a tab at the top of the screen that says “Explore,” either click it or drag it down

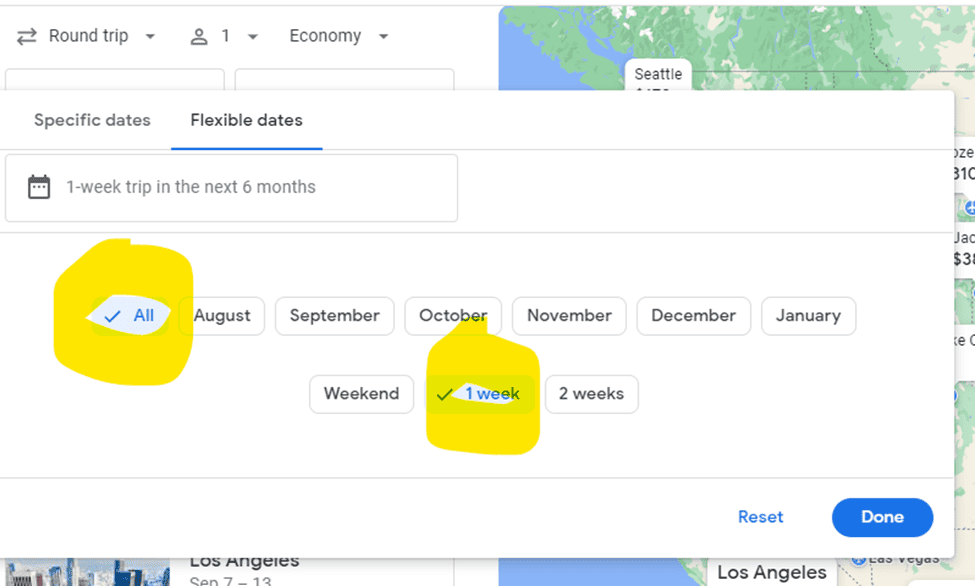

7. Click on the calendar

8. If you can be flexible but know you want to go for one week, select “1 week”

9. Then click “All” to the left of the months

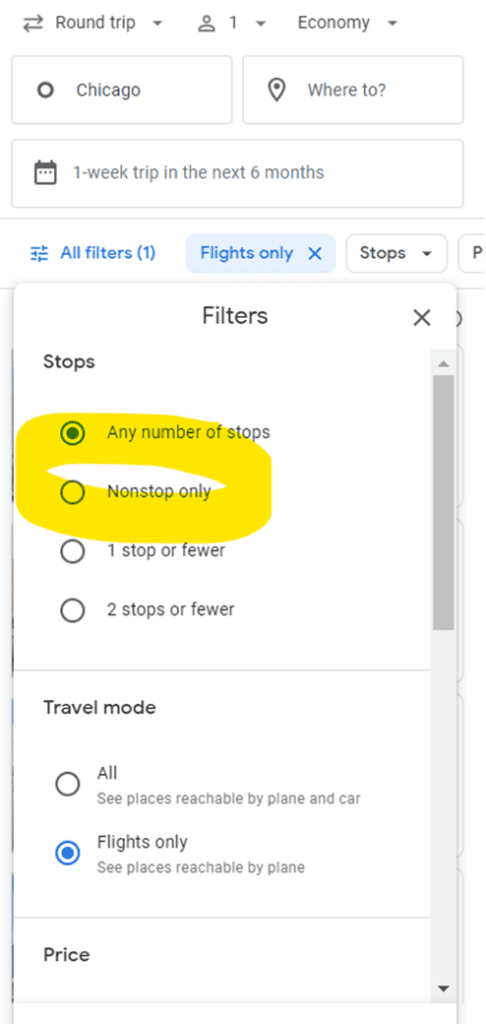

10. You can select non-stop in the filter section (if you would like to avoid layovers)

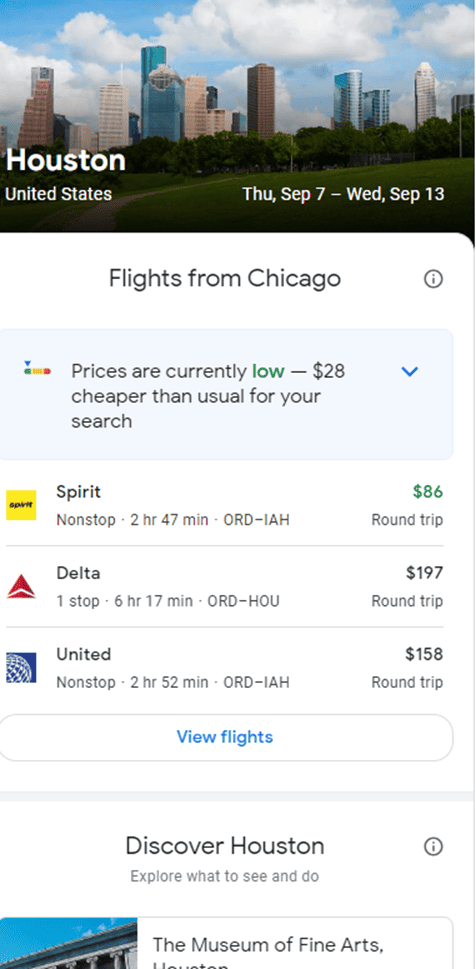

11. Choose your destination and click “View flights”

12. Purchase your flight and enjoy the money you saved!

Get MONEY$ from Airlines when you have flight problems

Was your flight delayed or canceled? Were you bumped off the flight or rescheduled on the next flight?

Example: you were rescheduled for more than 2 hours. The cost of one way trip= $300…the airline required to pay 4X or $1200 in compensation!

Make sure you read this, so you know when you’re owed compensation from the airline!

- First, go to https://www.transportation.gov/individuals/aviation-consumer-protection/flight-delays-cancellations

- Pull up the “Denied Boarding Compensation (DBC)” chart to see how much compensation that you’re owed by typing “dbc chart” into the search box

3. Click the first link:

- Don’t accept a mailed check or 10 business days or whatever they tell you

- The airline is required to pay you AT the airport SAME DAY

- Exception: they can’t pay you at the airport is when the substitute flight is leaving before they can pay you

- Remember that the next flight they put you on is FREE of charge!

Get Money from Airlines for baggage problems

Note- always make sure to take a photo of your baggage before you fly!

The airlines are responsible for up to $3800 per passenger for damaged bags– so when they deny your damaged bag, simply show them your time-stamped photo!

We hope that is a good start to helping you put money in your pocket; we plan to post a second list of “Little Known Tips, Secrets and Hacks that Put More Money in Your Pocket” soon so make sure you Google us and keep up with our blogs!